How High Are Property Taxes In California . Knowing the rate of property. How property taxes in california work. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. In california, property tax rates can vary, but they all start with a fundamental. The average effective property tax rate in california is 0.71%. Prior to 1912, the state derived up. This compares well to the national average, which currently sits at 0.99%. How much is property tax in california? The background of property taxes in california. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00.

from taxfoundation.org

The background of property taxes in california. How property taxes in california work. Prior to 1912, the state derived up. This compares well to the national average, which currently sits at 0.99%. The average effective property tax rate in california is 0.71%. According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. In california, property tax rates can vary, but they all start with a fundamental. Knowing the rate of property. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per.

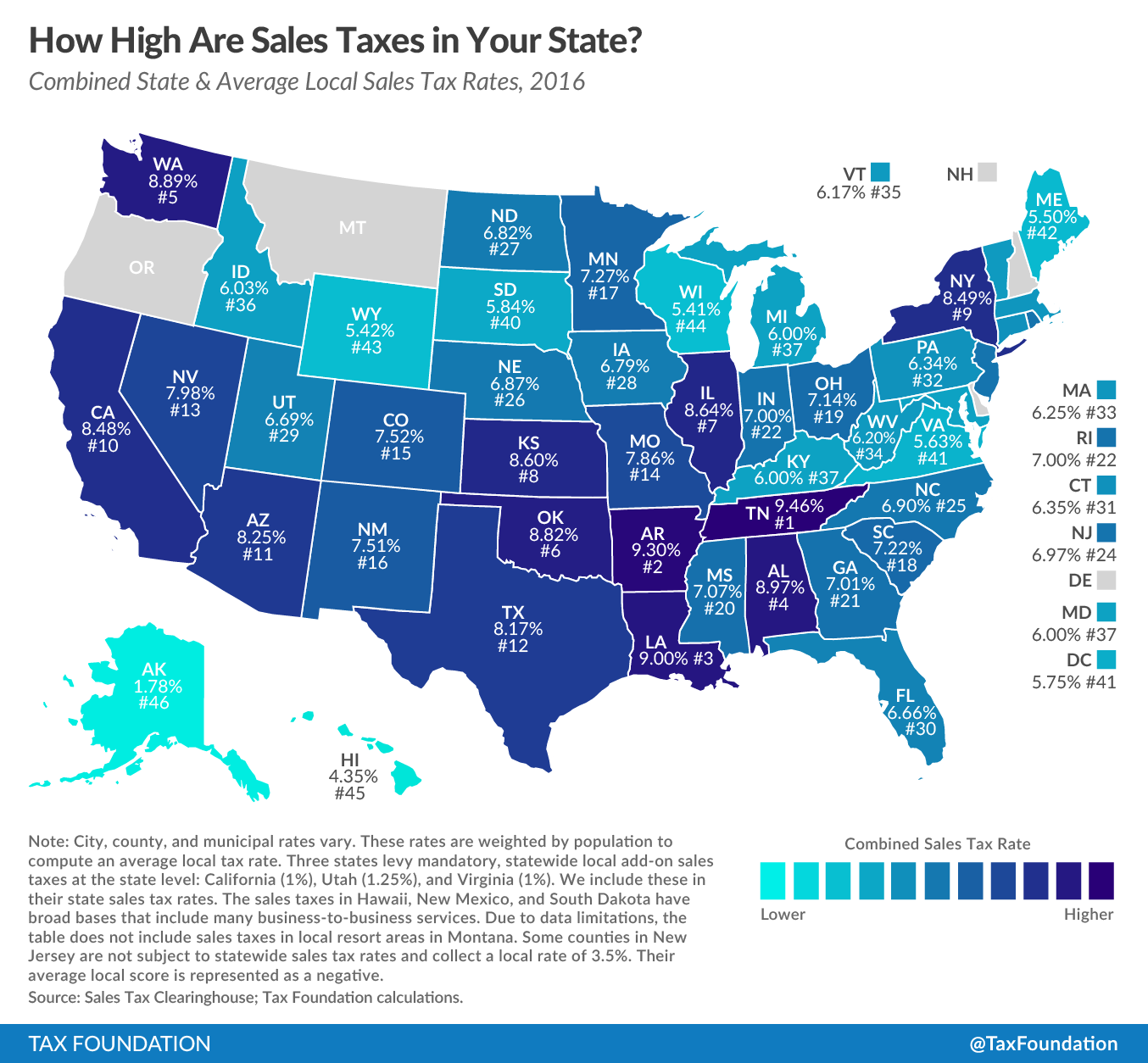

How High Are Sales Taxes in Your State? Tax Foundation

How High Are Property Taxes In California Knowing the rate of property. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. The background of property taxes in california. The average effective property tax rate in california is 0.71%. How property taxes in california work. Prior to 1912, the state derived up. Knowing the rate of property. In california, property tax rates can vary, but they all start with a fundamental. How much is property tax in california? According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. This compares well to the national average, which currently sits at 0.99%.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation How High Are Property Taxes In California Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. Knowing the rate of property. How property taxes in california work. According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. The average effective property tax rate in california. How High Are Property Taxes In California.

From www.desertsun.com

Property taxes are high enough. California must reject Prop. 5 How High Are Property Taxes In California Knowing the rate of property. In california, property tax rates can vary, but they all start with a fundamental. The background of property taxes in california. This compares well to the national average, which currently sits at 0.99%. Prior to 1912, the state derived up. According to data from the tax foundation, california had the 33rd highest effective property tax. How High Are Property Taxes In California.

From tucson.com

The cities with the highest (and lowest) property taxes How High Are Property Taxes In California This compares well to the national average, which currently sits at 0.99%. In california, property tax rates can vary, but they all start with a fundamental. How property taxes in california work. Prior to 1912, the state derived up. The average effective property tax rate in california is 0.71%. How much is property tax in california? Median property taxes in. How High Are Property Taxes In California.

From www.madisontrust.com

What Is the Most Taxed State? How High Are Property Taxes In California The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. The average effective property tax rate in california is 0.71%. Knowing the. How High Are Property Taxes In California.

From shawntracee.pages.dev

2024 Per Diem Rates California Abby Linnea How High Are Property Taxes In California How much is property tax in california? Prior to 1912, the state derived up. The background of property taxes in california. In california, property tax rates can vary, but they all start with a fundamental. This compares well to the national average, which currently sits at 0.99%. Knowing the rate of property. The average effective property tax rate in california. How High Are Property Taxes In California.

From www.cerescourier.com

Company rates Stanislaus County in top 10 where property taxes go How High Are Property Taxes In California Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. In california, property tax rates can vary, but they all start with a fundamental. Knowing the rate of property. The background of property taxes in california. The average effective property tax rate in california is 0.71%. This compares well to. How High Are Property Taxes In California.

From thriftmylife.com

From New Jersey to Ohio States with the Most EyeWatering Property How High Are Property Taxes In California The background of property taxes in california. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. How much is property tax in california? How property taxes in california work. The average effective property tax rate in california is 0.71%. Knowing the rate of property. According to data from the. How High Are Property Taxes In California.

From classmediamuscardine.z13.web.core.windows.net

Property Tax Information For Taxes How High Are Property Taxes In California How property taxes in california work. The background of property taxes in california. Prior to 1912, the state derived up. How much is property tax in california? The average effective property tax rate in california is 0.71%. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an. How High Are Property Taxes In California.

From birdierobb.blogspot.com

Birdie Robb How High Are Property Taxes In California The average effective property tax rate in california is 0.71%. How property taxes in california work. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. Prior to 1912, the state derived up. The background of property taxes in california. In california, property. How High Are Property Taxes In California.

From thriftmylife.com

Golden State, Golden Costs 23 Taxes That Hit Hard in California How High Are Property Taxes In California This compares well to the national average, which currently sits at 0.99%. The average effective property tax rate in california is 0.71%. Prior to 1912, the state derived up. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. How much is property. How High Are Property Taxes In California.

From www.ciprohome.com

How To Lower Property Taxes In California (2023) How High Are Property Taxes In California The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. This compares well to the national average, which currently sits at 0.99%. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. The. How High Are Property Taxes In California.

From violantewagnese.pages.dev

Property Tax In California 2024 Brina How High Are Property Taxes In California How property taxes in california work. Prior to 1912, the state derived up. How much is property tax in california? This compares well to the national average, which currently sits at 0.99%. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. Median. How High Are Property Taxes In California.

From engineeredtaxservices.com

Case Study Cost Segregation Analysis for a Retail Pharmacy in Lodi How High Are Property Taxes In California The average effective property tax rate in california is 0.71%. According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. The background of property taxes in california. In california, property tax rates can vary, but they all start with a fundamental. The average californian pays a property tax of. How High Are Property Taxes In California.

From bearswire.usatoday.com

Prepay property taxes? Now all New Jersey homeowners can for 2018 How High Are Property Taxes In California How much is property tax in california? According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. How property taxes in california work. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of. How High Are Property Taxes In California.

From georgialogcabin.locals.com

Shared post High taxes make Illinois homes unaffordable 🏠 How High Are Property Taxes In California According to data from the tax foundation, california had the 33rd highest effective property tax rate in the nation in 2022. How much is property tax in california? In california, property tax rates can vary, but they all start with a fundamental. This compares well to the national average, which currently sits at 0.99%. The average californian pays a property. How High Are Property Taxes In California.

From lanettewandrea.pages.dev

State Tax In California 2024 Adda Livvie How High Are Property Taxes In California Knowing the rate of property. Median property taxes in california rose from $4,017 in 2019 to $4,933 in 2023 — a nearly 23% increase, per. The background of property taxes in california. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. The. How High Are Property Taxes In California.

From www.lao.ca.gov

Understanding California’s Property Taxes How High Are Property Taxes In California Knowing the rate of property. This compares well to the national average, which currently sits at 0.99%. How property taxes in california work. How much is property tax in california? The average effective property tax rate in california is 0.71%. Prior to 1912, the state derived up. The average californian pays a property tax of 0.74% per year on the. How High Are Property Taxes In California.

From madonnawgrete.pages.dev

How Much Is Property Tax In California 2024 Shel Carolyn How High Are Property Taxes In California The average effective property tax rate in california is 0.71%. How property taxes in california work. The average californian pays a property tax of 0.74% per year on the median assessed home value of $384,200.00, which amounts to an annual sum of $2,839.00. According to data from the tax foundation, california had the 33rd highest effective property tax rate in. How High Are Property Taxes In California.